Accredited Offering (Now Closed)

Industry

Recent Articles

Back to the Reading Room-

Cocktail Recipes

Shake Up Your Summer with the “Summer Breeze” Cocktail from ONE ROQ

Read More -

Investing

Venture Pre-IPO Stock Vs Fixed Income Stock

Read More -

In The News

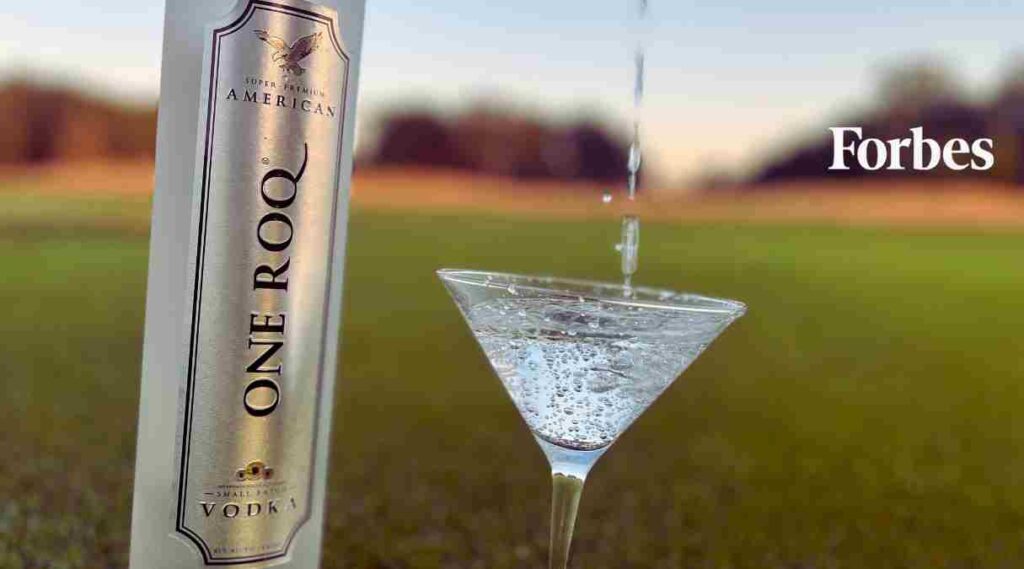

In The News: FORBES

Read More

or login here...

X

Experience More

Join the Club today to get unrestricted access to the ONE ROQ Reading Room, our exclusive channel for company news, events, and curated lifestyle content.

Join the Club

Login Now